AI Receptionist forFinance

Every call answered. Every booking opportunity protected, every request dealt with.

Finance & Lending AI Receptionist

Custom AI agents designed around your workflows, data, and commercial objectives for real-world performance.

According To Google, you could be loosing 63% of your enquiries due to unanswered calls

An AI Receptionist Finance and Lending solution exists to solve a quiet but costly problem across the UK finance sector: missed calls that result in lost applications, abandoned enquiries, and diminished trust.

In finance and lending, responsiveness is not optional. It directly influences conversion, compliance confidence, and lifetime client value.

This page explains how an AI Receptionist Finance and Lending system supports finance companies, mortgage brokers, and lending firms by ensuring every enquiry is handled promptly, consistently, and professionally—without increasing operational strain.

The Real Business Problem Finance Company Owners Face

Finance and lending businesses operate under constant pressure. Owners and teams are typically:

Speaking with clients about complex financial decisions

Reviewing applications and documentation

Managing compliance and regulatory obligations

Liaising with lenders, underwriters, and third parties

At the same time:

Calls go unanswered during focused work

Enquiries arrive outside standard office hours

Interruptions break concentration and accuracy

Call handling quality varies by availability

This is not a service failure. It is the operational reality of regulated professional services. However, prospective borrowers and introducers expect immediate acknowledgement. If they cannot reach you easily, confidence drops and enquiries move elsewhere.

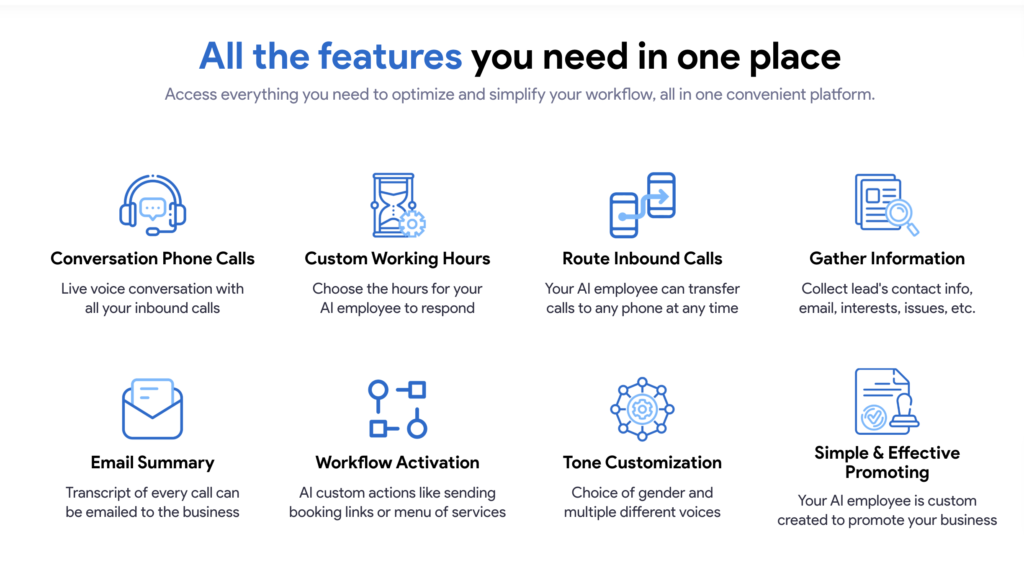

What an AI Voice Receptionist for Finance and Lending Actually Is

An AI Receptionist for finance and lending is a professionally configured voice call agent that answers inbound calls on behalf of your firm, understands the nature of the enquiry, and handles it according to your intake, routing, and compliance rules.

It is not:

Voicemail

A generic call menu

A scripted chatbot

It is a revenue protection and operational control system designed to ensure every enquiry is acknowledged, captured accurately, and progressed appropriately.

How It Works in Day-to-Day Finance Operations

From a business owner’s perspective, the process is controlled and reliable:

Every inbound call is answered immediately

Callers explain their requirements naturally

The AI identifies enquiry type (mortgage, loan, refinance, advice)

Key information is captured consistently

Enquiries are logged, qualified, or scheduled for follow-up

You receive structured call summaries and records

Your advisers remain focused on regulated, high-value work while enquiries are handled professionally in the background.

Commercial Benefits That Matter to Accountants & Bookkeeppers

Commercial Benefits That Matter to Finance and Lending Firms

Revenue Capture

Finance enquiries often represent high lifetime value. Missed calls reduce conversion before advice even begins.

Speed to Lead

Borrowers frequently contact multiple providers. The first clear, professional response gains a measurable advantage.

Client Confidence

Consistent call handling reassures clients making significant financial decisions.

Staff Efficiency

Advisers avoid interruptions that disrupt accuracy, compliance, and client focus.

Scalable Growth

You can increase enquiry volume without expanding front-desk or admin teams.

Why This Matters Now

Customer expectations in financial services have shifted. Immediate acknowledgement and clarity are assumed, not appreciated.

At the same time, compliance pressure, staffing costs, and workload intensity make manual call handling increasingly inefficient. The result is a silent disadvantage: capable firms losing opportunities simply because they are difficult to reach at key moments.

An AI Receptionist Finance and Lending solution removes this friction without altering how your firm delivers regulated advice.

Built for UK Finance and Lending Businesses

Effective call handling in finance must reflect regulatory and professional realities:

Clear distinction between advice, applications, and general enquiries

Accurate and compliant information capture

Professional, neutral tone aligned with financial services expectations

Consistent and auditable call handling

This is not automation for novelty. It is structured operational support for regulated businesses competing on trust and responsiveness.

Realistic Use-Case Examples

Mortgage enquiries answered outside office hours

Lending enquiries captured during adviser consultations

High call volumes following marketing campaigns

Small firms scaling without increasing administrative overhead

Each scenario delivers the same outcome: more qualified enquiries and less operational disruption.

Visibility, Reporting, and Control

Every call handled by the AI receptionist is recorded, logged, and reported. You gain visibility into:

Enquiry volume and peak times

Demand by product or service type

Missed opportunities prevented

Follow-up performance

This insight supports better resource planning, marketing optimisation, and client intake strategy.

A Sensible Next Step

If inbound calls influence your application pipeline and revenue performance, an AI receptionist is not an experiment—it is operational protection.

The next step is straightforward and low risk: See how an AI Receptionist Finance and Lending system would handle real client enquiries before committing.

No pressure. No disruption. Just clarity.

Real Satisfaction Starts with the customer

A Four-Step Process for Building Bespoke AI Receptionists

1. Foundation & Templates

Every project begins with proven receptionist templates, refined across real businesses. These provide reliable call flows, tone, and compliance as a starting point, not a limitation.

2. Bespoke Application Development

Templates are then adapted through custom application development. Call logic, language, and decision paths are tailored precisely to your business, customers, and operating hours.

3. Deep Integration

The AI receptionist is integrated with your existing systems—calendars, CRMs, booking platforms, and call routing—ensuring enquiries move seamlessly into your operations, not into silos.

4. Reporting, Recordings & Learning

Every call is recorded, logged, and analysed. You gain access to call recordings, performance reports, and generative AI learning that continuously improves accuracy, conversion, and call handling quality over time.

Hear Your Personalised AI Voice Demo